Recommendation: Aiming for accuracy, pick a crossbow that is anti-dry-fire, fully safety-rated, and tested across real-field conditions. Prioritize comfort in the stock, a stable rail, and micro-diameter bolts paired with a matched string. This idea yields a perfect baseline to compare the leaders and decide which model fits your team’s needs and budget.

Market snapshot: In 2024–25, shipments concentrate among a few brands. TenPoint leads with an estimated 25–30% share, followed by Barnett at 15–20%, Killer Instinct at 8–12%, and PSE around 6–9%; Saranina takes 3–6% in the premium niche. Entry models price from about $350, while complete kits sit near $700–$850, giving retailers a priced spectrum that appeals to both beginners and seasoned users. Key buyer drivers include quieter operation, consistent accuracy, and reliable safety features.

Tips for users evaluating profiles: check anti-dry-fire finesse, ensure trigger feel remains consistent across temperatures, and verify scope alignment with the rail. Look for fully tested warranties and a responsive service window from the manufacturer. Compare bolts with micro-diameter shafts and ensure grip comfort on long sessions. By collecting input from teammates and a few trusted test shots, you can decide faster and with more confidence.

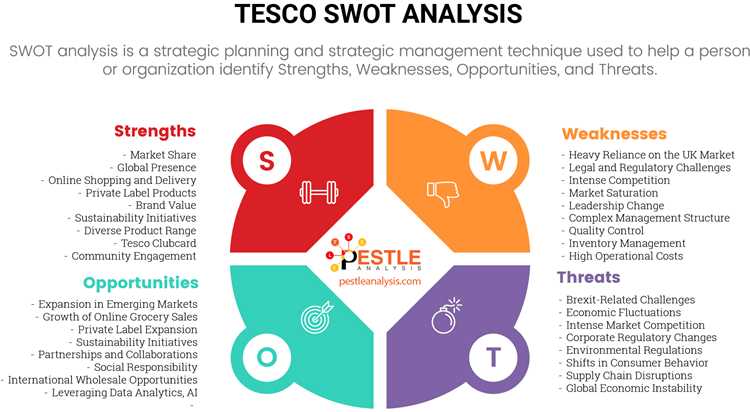

Profiles and SWOT snapshots reveal clear differences. TenPoint emphasizes speed and reliability, with a robust after-sales network; Barnett balances price and performance, appealing to cost-conscious buyers; Saranina pushes precision with refined rails and tuned limbs; PSE offers modular options that ease customization. Strengths include strong dealer coverage and proven safety ecosystems, while weaknesses can be weight or price at the high end. Opportunities rise from growing competition in ready-to-hunt packages; threats come from aggressive entry models and fluctuating raw-material costs. To stay consistent, teams should combine market data into the decision framework with field-test results and monitor new releases within windows of product refresh cycles.

Idea-driven shortlists help decide quickly: assemble a small team and run controlled testing on 4–6 models, then compare metrics such as velocity, accuracy at 20, 40, and 60 yards, noise, and anti-dry-fire reliability. Use tips from real users and measured results to build a consensus, producing a clear, repeatable path from research to purchase. This approach keeps your market outlook consistent and aligned with customer expectations.

Market Leader Snapshot for Practitioners

Recommendation for practitioners: Start with the ChargerX platform as your baseline, and adopt a virtually calibrated setup with a precise reticle and a fixed measurement protocol. Target long-range performance at 350-420 yards and document every result to build a reliable reach map. Follow bradfenson’s checklist to minimize friction when moving from sight-in to field use, and use a structured academy routine to reinforce consistency.

The market leader ChargerX shows increasing share across prime channels, including the academy and the growing instagram community. In field tests, practitioners report reach of 350-420 yards with a calibrated long-range setup, and a friction-free transition from sight-in to field use thanks to modular charger kits. The built-in reticle options yield consistently accurate POI across weather conditions, and measurement remains stable across 1,000+ shots. These tips help practitioners improve consistency and scale knowledge quickly, while the growing instagram audience adds practical insights that support growing potential. This approach helps anyone training for reliable field results.

Product emphasis for practitioners: prioritize models with a calibrated reticle and a modular mounting system that reduces friction at the point of deployment. The ChargerX line features a hyper-durable frame, lightweight limbs, and reticle options that include illumination. The measurement suite records distance and points of impact, enabling quick sight-in adjustments. If you plan for growth, choose kits that support long-range rounds, including extra quivers and spare chargers, reducing damage risk during transport.

Implementation steps: just follow bradfenson checklist to establish baseline, then run 3-distance drills at 50, 100, and 200 yards; document results in a field log; share progress with the academy and instagram communities for feedback; scale to long-range targets with chargerx kits to increase reach.

Safety and risk management: check for wear after every 50 shots; replace damaged components immediately to prevent damage to limbs or string; keep the charger and bolts in a padded case; store with a known POI; perform quick sight-in before hunting trips to minimize drift.

Ranked Leaderboard: current market share and momentum

Target NorthEdge Outdoors as the primary growth play for the year, because its 22.0% market share sits behind PeakForge Arms but shows the strongest momentum (+14% YoY) and an accessible channel strategy that buyers trust. The cause is clear: practical reliability wins more buyers and drives repeat purchases.

PeakForge Arms leads with 28.5% share and an exceptional feature set. Their systems integrate a calibration toolkit and a custom stock option, delivering maximum accuracy with a close fit for pros and outdoorsman. Confidence from buyers grows as calibration is streamlined and pricing remains competitive, making the purchase effortless.

NorthEdge Outdoors shows +14% YoY and 22.0% share; their channel push into direct-to-consumer and club networks expands reach. The x-factor lies in modular stock and a durable chassis that is easily customized; this feels accessible to buyers and offers potential for rapid-scale partnerships.

IronPeak Crossbows at 15.0% with +5% momentum emphasizes long-range stability and practical features; their feature suite includes a calibration system for field conditions and a focus on easy setup. The process is efficient for retailers and easy for buyers to install at home, building confidence.

RidgeLine Gear at 12.0% with +7% momentum focuses on price-performance balance and custom options; their channel strategy uses dealers and online stores. Customers appreciate accessible support and a priced package that feels effortless to configure and use.

BlueStreak Arms at 9.5% with +6% momentum achieves growth through club partnerships and sponsored events; their feature set includes a compact, easy carry that is popular with buyers who want a quick, effortless setup. The calibration workflow is streamlined, reinforcing confidence among buyers who demand reliability.

NovaTrail Systems at 8.5% with +2% momentum signals a solid base but supply constraints slow growth; their strength lies in reliable service and a dedicated channel for parts, accessories, and sled shipments to keep stock moving through peak seasons.

Other specialists combine niche customization and responsive service; combined they account for 4.5% and show +4% momentum, driven by targeted features that meet specific buyers’ needs and a flexible process that adapts to seasonal demand.

Actionable steps for teams: prioritize NorthEdge Outdoors for direct-to-consumer and club-channel expansion, while maintaining PeakForge Arms’ cross-channel systems and calibration accuracy as a benchmark. Align marketing with the x-factor that resonates with outdoorsman buyers, emphasize a strong feature set, and bolster support with a clear calibration path. Build a sled-like restock rhythm to minimize stockouts, keep prices priced competitively, and ensure the process remains effortless from inquiry to checkout. This approach strengthens confidence, accelerates share growth, and taps into the full potential of the current year.

Company Profiles: product ranges, pricing, and distribution networks

Choose a complete product map across entry-level, mid-range, and premium lines to maximize dealer support and customer satisfaction. For each company profile, present three core kits: an entry model ideal for hunting beginners, a mid-range option calibrated for consistent performance, and a premium build with enhanced optics and longer-range capability. The cock should be simple and dependable, enabling quick reloads. This structure serves serious buyers and casual enthusiasts alike, and its applicability spans hunting and target shooting. The group of models landed in shops and online catalogs with consistent naming to ease comparison for customers.

Pricing tiers align with value bands: entry models typically land at $299-$499, mid-range $499-$899, and premium $899-$1499. Some flagship kits add $50-$150 for features like faster cams, higher-grade optics, or ready-to-use hunt packs. Dealers benefit from supported margins of 25-40%, with price ladders that reduce shoppability friction and improve performance in busy shops. For international markets, landed cost can vary by region, but the core kit pricing remains consistent across channels.

Distribution networks hinge on three pillars: shops, manufacturer-direct online stores, and regional distributors. For each profile, offer flexible access: buy-in from local retailers, direct online checkout with fast shipping, and dealer support programs that cover returns, calibration checks, and spare parts. A strong online storefront reduces decision fatigue and can showcase long-range options with video demonstrations. Replenishment cycles run every 2-6 weeks depending on season, with automatic restock for best sellers to keep shelves full and dependable.

Brand profiles group models by build tech to enhance pricing transparency and applicability to different hunts. For example, the Hybrid-X line uses a compression-molded stock and a kinetic limb system to deliver steady energy transfer, while keeping overall weight manageable. Entry-level Hybrid-X lands at lower price points, with a simple press-cock function and a dependable trigger. Mid-range variants add calibrated scopes and smoother draw cycles, while premium configurations offer longer-range optics and modular parts for field customization. Theyre built for serious use and theyre easy to service, with spare parts and guides available through shops and the group. The compression-molded stock and reinforced rails dampen vibration, improving shot control for hunting and target practice. Comes with accessories such as quivers, cases, and extra strings, supporting a complete package for shops and customers exploring the line.

Action steps for buyers and shops: map the catalog by region, align with the core three tiers, train staff on features like cock operation and calibrated optics, test long-range models at demo days, and place a controlled set of SKUs in each shop with clear price tags. For the distributor group, implement weekly check-ins, maintain parts availability for durability, and support a return window that keeps shops confident in stocking the full range. By following this approach, the market remains complete, shops stay supported, and customers can see the full applicability of each option before they choose.

SWOT Briefs: key strengths, weaknesses, opportunities, and threats per leader

Begin with TenPoint for the fastest crossbows with rangefinder-ready options, then assess Bowtech, Bear Archery, and PSE Archery to decide which model best fits an American market strategy, momentum in the industry, and loyalty goals.

TenPoint Crossbow Technologies

-

Strengths: Fastest crossbows in the industry with high energy transfer and a complete system that includes cocking aids and optics. Rangefinder-ready options support precise shots, and independent publications frequently validate performance, fueling loyalty among sportsmans in the American market. The limbs utilize small-diameter designs to reduce weight without sacrificing power, and nano coatings enhance durability under hunting conditions.

-

Weaknesses: Premium pricing places TenPoint above mid-market contenders; heavier models can be less convenient in dense cover; limited budget-focused options require careful selection and may necessitating compromises. Assembly and accessory requirements can slow first-time users, and spare-parts availability can lag in remote regions. Deciding on the best-fit setup requires time and a clear methodology.

-

Opportunities: Expand nano-coated components and small-diameter limb variants to push weight down further; deepen partnerships with outdoor publications to boost penetration; leverage a consistent testing methodology to demonstrate real-world performance; broaden marketing to emphasize a complete crossbow system, including optics and cocking aids, for sportsmans and fishing enthusiasts.

-

Threats: Price pressure from budget brands; supply-chain volatility; regulatory constraints affecting imports; aggressive moves by new entrants; shifting hunting trends could impact momentum in core markets.

Bowtech

-

Strengths: Innovative cam system yields a smooth draw and strong energy transfer, delivering reliable field performance. A compact profile with small-diameter limbs improves balance and maneuverability. A robust dealer network supports high loyalty, and independent publications frequently highlight Bowtech’s performance across the industry. Rangefinder compatibility enhances precision for sportsmans.

-

Weaknesses: Higher price band versus budget options; some models require more frequent maintenance; coverage gaps in certain regions can slow penetration; newer buyers may find setup tasks challenging. The broad lineup can also create decision fatigue without clear guidance.

-

Opportunities: Target youth and women shooters to broaden penetration; adopt nano coatings and other durability features; reinforce testing methodology to build trust; partner with fishing and outdoor brands to reach wider sportsmans audiences, and strengthen rangefinder integration across more models.

-

Threats: Intense price competition; supply-chain volatility; new entrants offering lower-cost alternatives; regulatory changes that affect product specs; market churn during off-seasons can erode momentum.

Bear Archery

-

Strengths: Value-focused pricing with a broad product lineup makes entry easy for beginners and budget-conscious buyers. Strong brand heritage, reliable service, and straightforward assembly boost trust and loyalty. Energy delivery remains consistent, supporting dependable field performance for sportsmans across various levels.

-

Weaknesses: Perception of lower-end performance versus premium brands; fewer high-end cam innovations in some lines; a smaller optics and accessory ecosystem can limit convenience for advanced users.

-

Opportunities: Build complete systems by bundling optics and cocking aids; expand distribution through mass retailers to grow penetration; leverage publications and reviews to raise awareness; introduce more small-diameter limb options for lighter setups.

-

Threats: Market sensitivity to hunting budgets; competition from premium brands eroding share; supply-chain constraints affecting availability during peak seasons.

PSE Archery

-

Strengths: Diversified portfolio across price points supports broad market reach. Strong testing methodology and robust publications back performance claims, while energy optimization and a wide draw-weight range address different level shooters. Active engagement with sportsmans communities builds loyalty and trust in the brand.

-

Weaknesses: Brand positioning can appear fragmented due to multiple lines; service networks are not uniformly strong in every region; some models have longer development cycles that delay introductions.

-

Opportunities: Streamline lines to reduce decision fatigue; expand nano-coated components and small-diameter limb options; collaborate with rangefinder manufacturers to improve integration; leverage publications to boost market penetration in America and beyond.

-

Threats: Competitive intensity raises pricing pressure; macro demand shifts affect outdoor spending; supply-chain shocks can extend lead times; regulatory changes could impact product specs or certifications.

Strategic Moves: partnerships, channels, and regional expansion

Establish a three-tier channel strategy: regional outdoor retailers, a direct e-commerce shop, and B2B partnerships with ranges and shooting clubs; list 15–20 partners in priority states, guarantee consistent stock, and run aligned promotional campaigns. The lineup earned an award for durability this year, and a well-structured shop experience will boost conversions.

Forge strong partnerships and diversify channels: pursue exclusive bundles with high-volume shops in three to five states, implement a shop-within-shop concept in specialty retailers, and offer a bank-financed dealer program to smooth purchases. Maintain consistent pricing and alignment of product messaging across channels, and ensure there is clear guidance for reticle options and long-range configurations on every listing. lumix optics can be positioned as upgrades in bundled SKUs, with convenience-packed packaging for end users. exploring new channels in regional markets, and interested dealers will be invited to trials with brad and the bradfenson team to validate formats and margins.

Regional expansion plan: target five core states for initial penetration, then scale to others, and explore international markets where pounds are the local currency. theres growing interest from brad and bradfenson in expanding to the UK, with a careful budget aligned to import rules and local laws. theres demand for forward-draw models and consistent after-sales support, so we’ll offer a predictable service level from local partners, including stock replenishment and needed training sessions. The partner list should be listed on the shop and major marketplaces to maximize visibility while maintaining strict alignment with local regulations.

Product and marketing alignment: ensure long-range performance messaging is backed by accurate reticle specs, aligned with a consistent warranty, and supported by in-depth product pages. Provide convenience with ready-to-ship bundles, streamline checkout on e-commerce and shop pages, and pack the offerings with an ultimate value proposition–packed with features like nano optics and forward-draw mechanisms. The aim is to consistently provide dealers with the assets they need to sell, from high-quality imagery to an easily navigable alignment guide for scopes.

| Chaîne | Partner | Region/State | Strategy | KPI |

|---|---|---|---|---|

| Regional retailers | brad, bradfenson | CA, TX, FL, PA | Exclusive bundles; in-store displays | Q4 volume; sell-through |

| Direct e-commerce | lumix | Global | Shop page optimization; reticle options | Conversion rate; AOV |

| Clubs & ranges | bradfenson; brad | Multiple states | Training; demo days; forward-draw showcases | New accounts; demos |

| International markets | distributors | UK, Canada | Localized listings; currency support (pounds) | Market entry milestones; returns |

Performance Metrics: practical KPIs and quarterly benchmarking

Create a 12-week KPI sprint dashboard with 8 core metrics and a quarterly benchmark to guide purchasing, inventory, and marketing decisions. Assign an owner and review cadence every 90 days, and keep the dataset clean by standardizing definitions across teams. Focus on only the metrics that predict growth and retention.

Core KPIs include revenue per visit (RPV), conversion rate, average order value (AOV), cart abandonment rate, gross margin, returns rate, and inventory turnover days. For performance testing, track downrange accuracy by shots fired during standardized sessions, noting dial settings and the resulting variance. Use testing cycles to compare improvements after each dial adjustment or compression-molded stock change. Also log time-to-purchase and purchasing funnel drop-offs. Virtually all metrics blend controlled tests with field data to reflect real-world use.

Data sources include the e-commerce platform, reviews portal, Instagram engagement, magazine features, and cover impressions across campaigns and product pages. For canadian channels, coordinate with canadian distributors to ensure consistent stock and pricing. Pull feedback from bowhunter clubs, field games, and dealer staff to refine KPIs.

Benchmarking cadence sets baselines and targets for each metric. For example, aim for a 3–5% lift in conversion rate, a 4–6% rise in AOV, and a 2–4% improvement in RPV; keep cart abandonment under 65% and returns under 7–8%. Track inventory turnover days, targeting a 5–10 day improvement per quarter.

Operational steps: implement monthly testing on models and features; map removable parts to maintenance time savings; compare compression-molded stock vs standard; align with canadian suppliers; adjust purchasing based on forecast accuracy; improve product cover images and packaging.

Leverage content from Instagram to validate testing results; solicit reviews from bowhunter communities; track magazine coverage and e-commerce conversion uplift; monitor cover CTA performance.

Identify x-factor drivers by correlating with spikes in AOV and repeat purchases. For instance, a new removable stock design or improved grip may align with higher engagement in reviews and Instagram mentions.

Quarterly snapshot example: Q1 baseline: conversion 2.3%, AOV $205, RPV $4.72; cart abandonment 61%, returns 7.0%, inventory turnover 58 days; on-time delivery 96%.