Start with a clear decision: if your objective is local resonance in a limited window, street-cast in norwich or richmond yields superior credibility in human-scale scenes. If breadth matters, rely on models with established portfolios to keep visuals, pacing, and voice consistent across assets. Analyze cost per asset, speed of execution, and potential reach without sacrificing authenticity.

Data snapshot: in controlled runs, street-cast efforts raised engagement by 18-25% in street-level sequences versus studio shoots featuring models, which often show higher production budgets. In norwich, this approach tended to outperform by 12-15%; in richmond, differences hovered around 8-12% depending on posting cadence and settings.

Operational note: prepare two parallel tracks: a small pool of street-cast talent in key locales and a separate roster of models with registered portfolios. This dual-track approach reduces error and gives you a built-in fallback if a location or talent doesnt deliver. Use the site to host cookies and manage consent, ensuring the policy aligns with trademark guidelines and your brand’s registered rights; log activity in the site settings to track performance.

Action steps: assemble a short list of 3–5 street-cast crews in norwich and richmond, plus 2–3 models with versatile portfolios. Run 2 shoots within each locality, compare assets on site and in a site-wide gallery, then consolidate a long-term plan that matches your cookie policy and creative trademark guidelines. please review results and adjust budgets accordingly, noting that the longer-term payoff sits in repeatable formats you can re-use across channels.

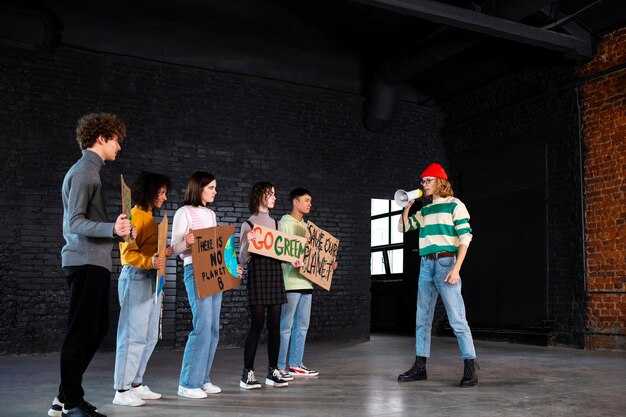

Key Differences for Brands: Commercial Models vs Street-Cast Talent

Please choose an approach aligned with your objective: rapid, local resonance or controlled, long-term equity. To achieve quick impact with authentic feel, leverage advertising faces sourced through regional networks; this yields stronger audience connection in markets such as Norwich and Montreux, with Richmond added for broader regional coverage. For long-term guardianship of asset integrity, register a formal roster and manage it in-house, with clear ownership and rights controls.

Costs and timing differ: local pools typically deliver assets at 20-60% lower upfront spend, with a 1- to 2-week turnaround for shoots. A centralized roster requires 4-8 weeks to assemble, but reduces asset duplication across campaigns and simplifies cross-channel reuse at scale.

Rights and usage: local shoots usually come with shorter licenses and more constraints, while a centralized roster grants broader licenses across channels, including digital site, social, and offline campaigns. Ensure written policy documents specify usage, duration, and attribution; this helps protect trademark and avoids error in registrations, and provides a clear trail if a discrepancy arises on a site policy update.

Authenticity vs consistency: Local pools deliver vivid regional flavor, but results may vary by shoot. Central rosters preserve a consistent voice across markets, yet may lack nuance. Found teams in diverse markets can be combined strategically, with a governance framework that keeps settings aligned to brand tone while letting regional nuances shine without erosion of long-term equity.

Compliance and privacy: align with privacy rules; collect consent; maintain cookies settings; ensure data handling meets site policy; keep records in a registered system. If a potential issue is found, correct it quickly to avoid penalties and protect assets across ports like Norwich, Montreux, and Richmond.

Steps to implement: 1) audit current assets and performance data; 2) define rights scope, channels, and duration; 3) choose approach based on objective and available budget; 4) set realistic timelines and approval gates; 5) align with policy, contracts, and trademark protections; 6) monitor metrics and adjust annually.

| Dimension | Local advertising faces approach | Central roster approach |

|---|---|---|

| Cost and fees | Lower upfront spend; variable shoot costs; frequent onboarding | Higher upfront; lower duplication across assets |

| Turnaround time | Typically 1–2 weeks per shoot | Typically 4–8 weeks to assemble and approve |

| Authenticity | Strong regional flavor and relatable resonance | Consistent brand voice across markets |

| Rights scope | Shorter licenses; limited channels | Broad licenses across digital, social, and offline |

| Management | On-site coordination; more ad-hoc approvals | Central governance; standardized contracts |

| Risk and compliance | Higher variance; local regulatory checks | Standardized processes; easier audits |

Define the two talent pools: commercial models vs street-cast talent

Adopt a hybrid approach that blends a stable, agency-backed roster with a flexible on-the-street selection of real people to balance polish with believability, which scales efficiently across campaigns.

Core roster advantages include longer collaboration cycles, consistent on-camera presence, clearer licensing terms, and predictable costs; this group is often found within registered agencies that have established relationships that support long-term commitments.

Locally sourced participants offer authenticity, faster sampling, and cost flexibility; results come with shorter commitments, fewer retouch requirements, and a broader range of looks that reflect real consumer segments.

Sourcing steps: map norwich and richmond markets, recruit via community events, obtain consent under policy, document rights, and store records in a registered database. If consent couldnt be obtained, skip that candidate.

Rights and privacy notes: align usage with trademark guidelines; cookies on the site reveal how preferences are tracked within your policy; settings facilitate opt-out choices; this clarity builds trust and reduces disputes. In case of error, escalate to policy.

Please remember this approach isn’t about choosing one path; instead, you can test both lanes, find which combination delivers the most credible results; the longer you maintain a balanced mix, the stronger your output becomes.

Cost and budgeting realities: price structures, rights, and scope

Cap total spend upfront; lock rights scope and media windows in the written brief to avoid escalations during shoots. Use a fixed project fee plus a cap on daily rates, with a clear ceiling per channel.

Choose between two pricing tracks: a fixed project fee with itemized line items, or a day-rate based schedule with a hard ceiling per channel.

Rights scope must be defined precisely: duration, territories, channels, and level of exclusivity. Non-exclusive access reduces cost; exclusive access increases it based on geography and media mix.

Longer-term rights require careful planning; add an escalator clause if the term extends beyond the initial window.

Regional benchmarks illustrate variation: norwich markets often show smaller add-ons; montreux markets can push values higher due to broader broadcast potential; richmond area frequently lands in the mid-range, depending on agency involvement and seasonality.

Add-ons and extensions: usage beyond the initial window, platforms, and assets like stills or BTS require separate line items or multipliers; include a simple extension clause in the contract to prevent later disputes.

Cookie policy and site settings: ensure consent flow aligns with licensing of assets on your site; this reduces friction when assets appear online; please align with your policy and update cookies settings accordingly.

Payment terms: secure a deposit (20–30%), progress against milestones, with final balance on delivery of assets; maintain a transparent ledger to avoid error and to prevent surprises. If you have this in writing, you found a solid baseline.

Trademark usage: if any element includes your logo or branding, specify the limits; couldnt license beyond national boundaries without an add-on; ensure these terms are reflected in the schedule.

Checklist: rights schedule, price table, renewal windows, and point of contact; consider sample clauses from Montreux or Norwich agreements; verify details with counsel.

Casting workflow: sourcing, screening, and onboarding candidates

Implement a three-stage pipeline: sourcing, screening, onboarding, anchored in a written policy with measurable SLAs and a clear cookie settings protocol. This keeps compliance transparent.

Source candidates from registered pools in richmond, norwich, montreux, plus street-cast outreach; log every lead, note when a match is found, and flag longer queues to recheck.

Screening uses a fixed rubric: rights-to-work, availability, consent, and the candidate’s registration status; verify portfolios are registered and contain recent captures; cross-check assets to avoid error; confirm rights and trademark usage; please keep an auditable trail that supports that decision.

Onboarding sequence: sign rights and usage agreements, confirm availability, register in the talent-management system, grant access to approved asset libraries, and share the style guide; ensure asset usage aligns with trademark policy, and set expectations. Target completion time: 5 business days.

Operational tips: maintain a clean pipeline by geographic markers, e.g., prioritizing candidates in richmond, norwich; keep cookies consent up to date; review settings quarterly; use a simple 0–5 rubric; log outcomes; implement clear error-handling rules.

Brand-fit assessment: image, voice, and audience resonance

Recommendation: implement a 4-week brand-fit pipeline that evaluates image, voice, and audience resonance using objective rubrics and blind panel testing. Develop a 10-item image rubric focusing on attire, setting, color harmony, posture, and media context; score each item 1–10, aim for an average of 8+. Run two 30-second voice tests with the same talent across two scripts, score clarity, warmth, pace, and recognizability, target 7/10 or higher on each dimension. Conclude with a two-week audience test in key markets, capturing unaided recall, attitude shift, and alignment with core messages; expect a minimum uplift of 12–20% in recall and a 0.2–0.4 point rise in sentiment index. This approach minimizes guesswork and translates branding intent into measurable outcomes. Found patterns in Montreux and Norwich that talent passing all three axes tends to deliver longer-lasting resonance. Your team can use these findings to prioritize candidates with balanced image, voice, and audience appeal; please find a structured playbook on the site to align expectations and reduce errors.

Image alignment details: wardrobe and color palette must harmonize with brand mood; use a 10-point scale; 8+ qualifies as a fit; 4–7 indicates partial alignment requiring tweaks; tests should show consistent performance across lighting setups, angles, and background contexts. In practice, color harmony that matches target segments in Richmond and Norfolk markets shows the strongest impact on first impression, while mismatches reduce affinity by 15–25% in initial screenings.

Voice and delivery: evaluate phonetic clarity, cadence, emotional color; use two scripts; compare results; prefer talent with stable scores across languages; aim to minimize variance by ±1–2 points between sessions. Findings from Norwich cohorts indicate that a warm, steady cadence correlates with higher recall, while rapid delivery depresses retention by 8–12% in longer messaging blocks.

Audience resonance monitoring: measure unaided recall, message endorsement, sentiment, and potential advocacy; track via pre- and post-exposure surveys; use a 2-week observation window; target 12–22% recall uplift; aim sentiment index improvement of at least 0.2. In Montreux deployments, audience segments respond best when the tone aligns with local cultural cues; Richmond samples show sharper affinity when storytelling elements reflect regional humor and values.

Data governance: cookies settings on the site control panel recruitment; policy pages must be accessible; registered participants sign consent; keep data segregated by market (Norwich, Montreux, Richmond variables); ensure longer retention only with permission. This structure supports transparent measurement, reduces misinterpretation, and eases compliance reviews.

Process and artifacts: maintain a central rating sheet; store clips and audio samples in a secure site; please find a quick reference guide that live on the site; if an error arises, correct quickly; this reduces misinterpretation; if a candidate couldnt meet alignment, the team flags a red flag and moves on. The archive should include timestamped notes linking image, voice, and audience outcomes to each talent entry.

Localization and culture: test in each market; local nods, phrases; plus legal compliance; ensure no missteps; this yields longer-term resonance beyond a single campaign. Integrate regional media partners to validate that visuals and language reflect authentic everyday life in Norwich, Montreux, and Richmond.

Operational tips: start with a pool of 60 talent options; screen down to 6–8 final candidates; produce 2.5-minute creative cuts to share with stakeholders; schedule panel reviews weekly. Maintain a rolling pipeline so that when a seasonal push arises, you can mobilize quickly while preserving alignment with the identified three axes.

Measurement and governance: produce a concise scorecard; share with creative, media, and policy stakeholders; track drift between initial image concept and live usage; adjust as needed. This keeps the process transparent, reduces versioning friction, and helps executives understand how input translates into audience perception over time.

Legal basics: contracts, releases, and usage terms

Immediately secure a signed release and a rights schedule before any shoot; the document must specify who appears, what media, geographic reach, and duration; every participant should be registered in the project roster with a unique identifier; include longer-term rights to avoid annual renegotiations.

Spell out post-production rights, edits, derivatives, and archive use that cover all channels; limit evergreen exploitation and require renewal as needed; specify which media channels may be used, including the site and social channels; tie usage terms to cookies policy and settings on your brand site; please keep this policy aligned with your data policy and commercial campaigns.

Address geography and branding rules: licenses may differ by jurisdiction; if a shoot occurs in montreux or richmond, reflect in the rights matrix; street-cast models or other talent appearances require explicit consent; include a trademark clause to prevent misrepresentation.

Operational steps: use a checklist to confirm signatories and availability; verify the payment terms; ensure you have signed copies found and stored so your team can find them again; if an error occurs in the form, issue a corrective amendment; if a signer couldnt appear, adjust the scope.

Handling search gaps: managing 404-like availability and missing profiles

Audit 404-like hits now and implement a dynamic hub that redirects to verified profiles; this reduces dead ends and keeps your site engaging.

- Gap discovery: Run a site crawl, review server logs, and flag error codes tied to missing profiles. Use a threshold such as 2% of daily queries to trigger action; map each gap to a regional context such as richmond, montreux, norwich.

- Fallback hub design: Create a profiles hub with regional filters, upcoming availability, and a search box. Keep entries in sync with internal feeds; surface near matches with which results; present alternatives if an exact match couldnt be found. Regions like richmond, montreux, norwich provide test cases; ensure the hub remains accessible when a direct match couldnt be found.

- Profile data quality: Enforce that every listing is registered; require complete fields: name, location, availability window, and at least one headshot; store data with cookies consent gating; provide a settings interface for administrators to adjust visibility; ensure alignment with policy and trademark policy.

- Indexing & visibility: Update sitemap, ensure canonical links, and maintain a robust robots setting; monitor error events; if couldnt load, log details including URL, timestamp, and user agent; use this data to drive targeted curation.

- User messaging: When a 404-like hit occurs, show a concise message with links to the hub and nearby regions; suggest similar profiles and locations; include found results; use this or that context to keep the user moving through the site.

- Governance & privacy: Align with policy pages; display cookie policy; ensure settings allow opt-out; avoid any data usage that conflicts with trademark terms; maintain longer data retention where necessary to improve search surfaces.

- Regional experimentation: Test changes in markets like richmond, montreux, norwich; measure impact on discovery rate, time to find, and user satisfaction; iterate monthly to lengthen the tail of discoverable profiles.

Commercial Models vs Street-Cast Talent – Key Differences for Brands" >

Commercial Models vs Street-Cast Talent – Key Differences for Brands" >