Recommendation: Focus on the 5 fastest-growing stores within the 25, model their moves, and apply the best lessons to your niche today.

Use a view of the market that blends analytics with storytelling. This empowering approach helps you track rates like attention-to-purchase and note how top accounts craft posts to drive action.

Time-zone alignment matters. Schedule posts to dallas time to catch peak engagement, then measure daily performance and adjust quickly. This discipline pays off, especially today.

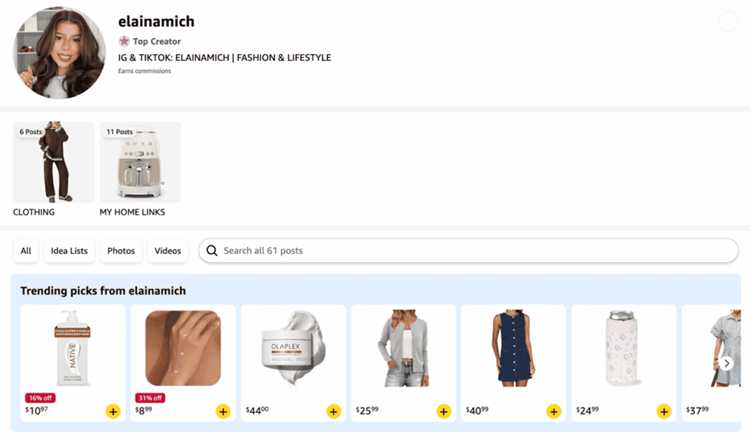

The top stores stay focused on a clear niche, often blending product picks with immersive storytelling. A young audience responds to approachable voices and digestible formats.

An insider tip from stacie and paterno points to using findsamazon to identify rising stores, then emulate their rhythm. macduff notes that a cadence of three posts per week yields consistency.

For a quick view: assemble a 3-week sprint with weekly checkpoints. Record the stores by niche, track rates, test storytelling formats, and transforms results into a repeatable framework you can scale.

Industry Landscape for Amazon Influencer Stores

Start a structured project that ties exclusive product drops to influencer media to shorten the path from impression to purchase and boost shopping conversions. Build modular catalogues that can scale with seasonal themes, then export learnings to product teams for faster execution.

Key indicators from the 25 top stores in 2025 show how momentum is built:

- Combined sales reached approximately $1.8B, with the top quintile turning more than a third of total revenue; international export activity rose to 62% of stores shipping outside the US.

- Exclusive bundles and limited‑run drops highlighted as the main growth lever, contributing about 18% of revenue and lifting repeat purchases by double digits.

- Content cadence tightened; continuous posting of shoppable media boosted click‑to‑purchase rates by 9–12% across the cohort.

- Management alignment matters: when product, media, and merchandising align under a single head, the end‑to‑end cycle shortens and margins improve.

Strategic pillars that firms leaned on, as noted by moretti of kluwer, include:

- Integrated planning: a strategist coordinates product pieces, media calendars, and shipment windows to create a seamless shopping experience.

- International readiness: export workflows scale with localized descriptions, imagery, and currencies, turning global interest into revenue.

- Quality storytelling: timeless belief in durable value and style drives higher engagement; campaigns emphasize exclusive, stylish experiences that feel premium rather than transactional.

- Operational governance: clear accountability for marketing, logistics, and customer service reduces frictions and improves margins.

- Talent and leadership: a strong head of merchandising anchors the team, while ruth and baudino teams demonstrate continuous improvement in creative execution and data‑driven decision making.

Implementation tips for practitioners:

- Pair product launches with media experiments: run A/B tests on creative formats and measure incremental shopping lift.

- Build export‑ready categories: focus on SKUs with scalable packaging, clear instructions, and localized descriptions to support international shoppers.

- Maintain a stylish yet timeless catalog: mix evergreen pieces with exclusive drops to sustain interest beyond peak seasons.

- Invest in dashboards and routine reviews: management reviews should occur weekly to adjust campaigns and inventory turns.

- Nurture the fortune of continuous learning: use a small cross‑functional project team to synthesize insights and implement changes quickly.

Inclusive Criteria: How the 25 stores were selected for 2025

Recommendation: publish a transparent scoring rubric and apply it consistently across all stores to justify the 2025 picks. The main criteria rest on five pillars: consumer impact, main category strength (outfit, medtech, sweetsavingsandthings), curation quality, influential collaborations, and scalable potential. We collect quick data through lumapps and cross-check with field teams to keep the view precise and ready for action. Voices from industry players such as joshi, pratham, nicholls, and ashlan help validate the pool and align with market realities for the future of shopping.

Each store earns points on (a) consumer reach and active engagement, (b) clarity and consistency of curations, (c) the strength and relevance of collaborations, and (d) the potential to deliver award-worthy campaigns without heavy operational changes. We also reward crafting a coherent outfit-led narrative that resonates across audiences and demonstrates a ready supply chain, backed by evidence of impactful campaigns that bring measurable gains.

Beyond category breadth, we ensure geographic and brand diversity, with coverage across main consumer segments and a sense of future-ready product lines. The selection favors stores that can scale with minimal friction, maintain ongoing experimentation, and generate quick wins for shoppers seeking value in outfits, health-tech solutions, and sweetsavingsandthings. The process benefits from insights shared by nicholls and pratham to maintain a balanced, inclusive portfolio that feels influential and relevant across markets.

Data Sources and Time Frame: Ensuring reliable sales figures

Recommendation: triangulate data from three sources and apply a 90-day rolling window to anchor reliable sales figures. This approach reduces bias from a single source and yields a single, auditable baseline, more reliable than relying on any one dataset. It combines time-tested controls with innovation in data reconciliation to stay accurate across campaigns.

Sources include Amazon Seller Central reports for orders and refunds; Amazon Brand Analytics for shopper behavior, search terms, and conversion; and CPaaS-connected dashboards or partner trackers to cross-check volumes. Align units (units vs. revenue) and map SKUs to a universal key to avoid double counting. Link back to the promo calendar to surface promotion-related shifts.

Time frame and granularity: use a trailing 90-day window anchored to month-end, refreshed on the first business day of each month. Tag promotions separately and apply a 14-day lift-off window to isolate promo effects from regular demand. Break down figures by category, including wearable, to spot category-specific dynamics. Compare three consecutive months to provide sharper trend signals.

Data governance and team roles: maintain a shared data dictionary, automated validation rules, and anomaly alerts. Keep inputs organized and analytical so stakeholders such as madhuri, richter, kaeli, chauland, and woodbridge can review quickly. Use motions of governance: weekly checks and monthly reconciliations; keep narrative notes in a centralized file labeled everythingenvy to provide context and ensure the link to sources remains accessible.

Operational steps: publish a link to the data dictionary; run three automated reconciliations; launching a shared monthly report; include a faves section highlighting top performers; track wearable category performance; monitor promo events with dedicated tags and ensure every data point cites its source. A recent launch by a partner at woodbridge boosted reported sales in the wearable line, which our team flagged as a temporary promo lift and adjusted accordingly.

Snapshot Profiles: Revenue, audience reach, and growth trajectories

Invest in cross-category bundles and time-bound drops to lift revenue by 18-28% over the next 6-12 months. Build a unified content and marketing calendar, track results in a spreadsheet, and align with audience preferences across shoes, decor, and fashion accessories. These steps reduce challenges and create predictable buying moments, enabling you to grow efficiently and empower creators to scale their brands.

rochelle brown blends stylish shoes with home decor content, delivering a cohesive lifestyle narrative. In 2025 YTD, revenue reached $2.3M, audience reach expanded to 1.75M, and quarterly growth sits at 34%. The plan: run 2 product drops per quarter, pair shoes with decor bundles, and publish 4 guides that show how to mix items into everyday spaces. Use the operating cadence of weekly posts and one live session per month to keep engagement high. Investments in a secure checkout and credibility signals improve security and conversion.

jack leads with practical, value-driven content that combines everyday tech and lifestyle. Revenue for 2025 stands at $1.4M; audience 980k; growth 22% quarter over quarter. Action plan: test 3 drops per quarter and optimize cross-promotions with marketing partners; track ROI in a spreadsheet, monitor CAC and ROAS, and refine creatives weekly. This approach centers on reliable storytelling that serves practical needs and helps followers solve real problems.

cyndi drives design-forward decor and DIY stories that resonate with home improvement shoppers. 2025 numbers show revenue around $1.95M, audience 1.4M, and growth near 29%. Strategies include weekly decor tips, seasonal drops, and collaborations with rochelle brown and jack to broaden reach. Cyndi’s operating rhythm pairs live demos with guided tutorials, supported by comprehensive guides and a simple spreadsheet to track spend and return. This approach empowers followers to recreate looks and expands brand affinity within the home category.

The snapshot reveals that each profile thrives by a clear, documented plan within the operating framework. They focus on revenue growth, audience reach, and sustainable momentum within a tight content calendar. Weve documented playbooks for onboarding and scale, and a single spreadsheet tracks drops, spend, and returns to keep marketing decisions aligned. This visionary stance empowers teams to serve followers with practical tips and stories that resonate in decor and shoes categories, reinforcing a clear path for a rewarding career as an influencer.

Niche Breakdown: Dominant product categories among the top earners

Begin with a data-driven focus on beauty and home essentials; these categories consistently capture the largest share of earnings among the top Amazon influencer stores, driven by repeat purchases and bundles that drive higher AOV. This approach drives higher AOV across campaigns.

olivia demonstrates how inspiration and logic align with platform strategies, turning content into conversions across Amazon, social feeds, and live sessions.

From the top earners, partnerships with developers and new programmes accelerate the development cycle. Chicago-based teams and networks such as abrego and snipes optimize deals and content calendars, while thesweetimpact demonstrates the value of exclusive offers. Chanel-inspired beauty bundles illustrate premium positioning, and Farrow-inspired home goods prove the appeal of practical, well-designed selections. Contacts via gmailcom coordinate cross-promotions and influencer outreach.

| Category | Share of top earners (%) | Key product examples | Why it performs |

|---|---|---|---|

| Beauty & Personal Care | 28 | serums, skincare tools, premium masks | High repeat purchases; bundles boost AOV |

| Home & Kitchen | 22 | organizers, smart plugs, compact appliances | Practical daily use; broad appeal |

| Health & Fitness | 14 | resistance bands, massage devices, wellness apps | Growing demand; subscription-friendly |

| Tech Accessories & Gadgets | 12 | wireless earbuds, chargers, cases | High impulse buys; strong margins |

| Fashion & Accessories | 9 | athleisure, bags, jewelry | Visual appeal; seasonal campaigns |

| Baby & Kids | 7 | feeding gear, bottles, safety products | Trusted brands; repeat purchases |

| Personal Care & Wellness | 4 | vitamins, aromatherapy | Low churn; renewals with care routines |

| Other | 4 | pet items, crafts, novelty items | Diversification; niche experiments |

Recommendations: Prioritize Beauty and Home, create 2–3 bundle offers per week, and run limited-time deals. Leverage collaborations through platforms and programmes to expand reach; keep contacts updated via gmailcom and track performance by category to guide expansion into Tech Add-ons after initial growth rounds.

Monetization Tactics: Affiliate links, promotions, bundles, and launches

Start with a targeted affiliate engine: pick 8-12 core products that align with your audience (makeup, book, accessories), map them to weekly content pillars, and set trackable links with a 30-day attribution window. This strategic focus, launched early, sets a measurable baseline for growth.

- Affiliate links that convert

Place product links where viewers engage most: video descriptions, in-video overlays, blog posts, and pinned comments during live streams. Use explicit disclosures and UTM tags to tie sales to each host and channel. Focus on 2-3 anchor products per niche and drive 60-70% of affiliate revenue from these anchors; cross-sell with 1-2 bundles to lift average order value. Place links anywhere hosts appear, not just on your site.

- Promotions that create urgency

Run 3- to 5-day promos aligned with launches or seasonal themes. Offer unique codes for subscribers, and coordinate codes across platforms so the same deal is easy to share. Test two discount tiers (eg, 10% vs 20%) and compare conversion rates; pair codes with landing pages that reinforce content value and authenticity.

- Bundles that raise AOV

Develop curated kits by theme: makeup starter bundle (primer + foundation + brush set) at a 12–25% bundle discount; reading bundle (the book plus a noted notebook and pen); tech-and-accessory bundles for day-by-day setup. Limit stock for scarcity, highlight free shipping thresholds, and spotlight bundles in tutorial videos and hosts’ descriptions.

- Launches that sustain momentum

Coordinate pre-launch waitlists, early-access windows for VIPs, and cross-promotions with partners. In the first days after launch, feature daily content that unpacks the bundle, shows real-use scenarios, and links to the promo. Track cohort revenue by launch and iterate weekly. Maybe run a long-tail follow-up week to capture lingering demand.

Case snapshots and practical notes: eran, an analyst, maps channel performance across platforms and helps you connect content with the right audience. hande trantham spearheaded a limited-edition bundle that combined makeup with a complementary book, and it sold out in days, illustrating the power of cross-category pairing. baudino’s framework for ecosystem-building shows how influencers like lewis and jack can amplify reach by collaborating with hosts across channels, not just their own feeds. The result is authenticity that resonates with followers who crave practical value, not just promotion. The days when a single post moved revenue are over; a coordinated, multi-channel launch with clear roles–including students and inspiring creators–delivers steady growth. In uber-competitive markets, operating across ecosystems and channels keeps momentum, while always maintaining focus on value and transparency for your audience.

hande trantham spearheaded a limited-edition bundle that blended makeup with a related book, proving that partnerships across categories boost both perception and sales. Stories from lewis and jack illustrate how authenticity, paired with diva-level storytelling, connects with audiences anywhere. This approach, built around a clear connect strategy and ongoing inspiration, helps you nurture an ecosystem where promoters and followers grow together day by day.

Actionable Roadmap for New Influencers: Steps to reach the top 25 in 2026

Begin with a 90-day sprint to build a scalable Amazon Influencer storefront that targets a 2026 top-25 finish, combining a precisely targeted product mix with high-impact content across video, images, and text.

Define a focused niche that is affordable to source and attractive for shoppers; select 3–5 core categories with 4–6 anchor SKUs per category. After validation, expand to 8–12 items. Look at claudia and houghton for early signals on demand, margin, and velocity to minimize risk.

Spearheaded supplier outreach to lock in private-label options and exclusive bundles, ensuring affordable price points for customers and better margins for the store. Use a span of 60 days to finalize three supplier agreements and initiate small-batch testing.

Build a content blueprint that blends wide formats: short clips, unboxings, tutorials, and customer stories. Align formats with product details and include a clear call to action on every post to drive conversions.

Set a management framework with programmes for weekly sprints, milestone reviews, and cross-team handoffs. Use a lightweight dashboard to track CPC, ACoS, conversion rate, and revenue per visitor, reviewing every two weeks to stay aligned.

Engage collaborators: tran, ferguson, tucker, carlene, and alix_earle to co-create bundles and cross-promotions. This intersection of creator audiences accelerates reach and credibility; plan a launch after testing to compare performance and iterate quickly.

Launch a capsule range inspired by alix_earle; after market testing, deploy private-label variants that align with brand aesthetics and shopper expectations. This approach reduces risk and fosters repeat purchases.

Extend distribution beyond a single channel anywhere shoppers start their searches: Amazon Storefront, social feeds, and live sessions. Maintain a private ecosystem for early access and exclusive drops that fans can join through simple sign-ups.

Careers: assemble a lean team with clear roles in product, content, and channel management; define progression paths and onboarding cycles to attract talent like tanwistha for cross-functional programmes and growth opportunities.

After the first quarter, refresh the product mix based on performance data, tighten pricing where needed, and double down on the winners. Publish a concise results reel for stakeholders and set new milestones to sustain momentum into 2026.